What does retirement cost in 2025?

Every year, Pensions UK updates its Retirement Living Standards, to give people a better idea of how much they will need in retirement. So what does retirement cost in 2025?

Do you know how much you might need in retirement? Every year, Pensions UK updates its Retirement Living Standards, to give people a better idea of how much retirement will cost them – and to help them plan accordingly.

Thanks to falling energy prices and shifting expectations, the cost of achieving a Minimum retirement lifestyle has actually gone down. But if you’re aiming for a Moderate or Comfortable retirement, costs are up slightly, thanks to inflation in everything from food to holidays – though utility bills have softened the blow.

What are the Retirement Living Standards?

Developed by Loughborough University’s Centre for Research in Social Policy on behalf of the PLSA, the Retirement Living Standards help people picture what life in retirement could look like – and how much it might cost. The standards cover three lifestyle levels:

- Minimum – covering the basics with a few small extras

- Moderate - a bit more financial freedom

- Comfortable – more luxuries, such as more holidays and weekends away as well as more spare money to enjoy meals out

They’re grounded in research with people across the UK, so they reflect what retirees actually want and need.

What’s changed for 2025?

Thanks to falling energy prices and shifting expectations, the cost of achieving a Minimum retirement lifestyle has actually gone down. But if you’re aiming for a Moderate or Comfortable retirement, costs are up slightly. This is due to inflation in everything from food to holidays – though reduced utility bills have softened the blow.

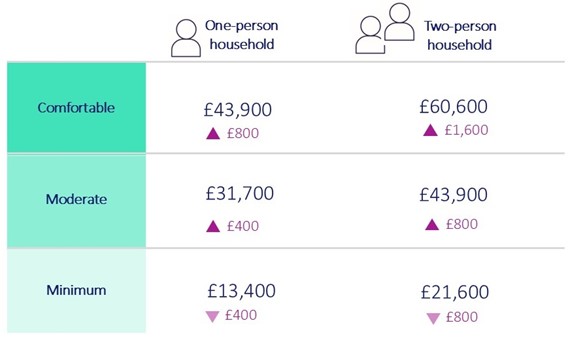

The new figures are shown below (after tax amounts):

The role of the State pension

The state pension continues to play a vital role, especially for those in two-person households as it typically covers the essentials needed for a Minimum standard of living. But for those hoping for anything beyond the basics, they’ll need more than just the state pension, which is where a workplace pension can play an important role.

Are you saving enough?

Auto-enrolment is helping more people save, but the current 8% minimum contribution rate might not be enough to guarantee the type of retirement lifestyle you want. Pensions UK recommends aiming to contribute at least 12% to boost your chances of a Moderate or Comfortable retirement. If you’re currently saving the bare minimum, now might be a good time to review your finances and see if you’re able to contribute any more to help improve retirement lifestyle.

To see if you’re on track for the type of retirement lifestyle you want to achieve, why not try the ‘Boost your savings’ tool in your online account?

To learn more about the Retirement Living Standards, visit the Pensions UK website.

Related news & insights

-

Retirement now

Retirement today looks very different to how it did in the past, however, many of the principles remain the same. Read our article to find out how retirement is changing, what a typical retirement costs and how to find out if you’re on track. -

Making an impact – understanding our impact investment promises

In July 2022, we began to invest around £75million in ‘impact investments’. This means that, over the next few years, a small proportion of your pension savings will now be invested in funds that drive social and environmental change. -

Introducing the Islamic Global Equity Fund

As you save for retirement, you can invest your money in the things that are important to you – and that may be a better fit with your personal beliefs. As part of this approach, we have launched the TPT Islamic Global Equity Fund. -

The power of your pension: responsible investing

Your pension plays a vital role in funding your future – but it can make the world a better place, too.