What does retirement cost in 2025?

Every year, Pensions UK updates its Retirement Living Standards, to give people a better idea of how much they will need in retirement. So what does retirement cost in 2025?

Do you know how much you might need in retirement? Every year, Pensions UK updates its Retirement Living Standards, to give people a better idea of how much retirement will cost them – and to help them plan accordingly.

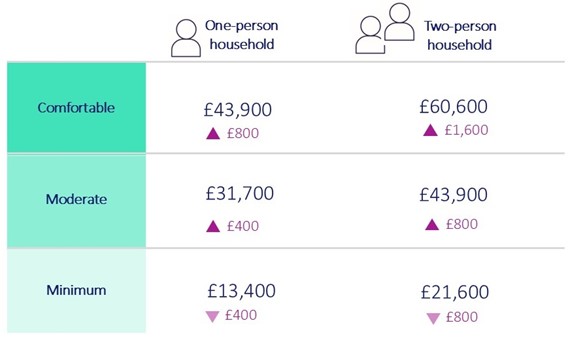

Thanks to falling energy prices and shifting expectations, the cost of achieving a Minimum retirement lifestyle has actually gone down. But if you’re aiming for a Moderate or Comfortable retirement, costs are up slightly, thanks to inflation in everything from food to holidays – though utility bills have softened the blow.

What are the Retirement Living Standards?

Developed by Loughborough University’s Centre for Research in Social Policy on behalf of the PLSA, the Retirement Living Standards help people picture what life in retirement could look like – and how much it might cost. The standards cover three lifestyle levels:

- Minimum – covering the basics with a few small extras

- Moderate - a bit more financial freedom

- Comfortable – more luxuries, such as more holidays and weekends away as well as more spare money to enjoy meals out

They’re grounded in research with people across the UK, so they reflect what retirees actually want and need.

What’s changed for 2025?

Thanks to falling energy prices and shifting expectations, the cost of achieving a Minimum retirement lifestyle has actually gone down. But if you’re aiming for a Moderate or Comfortable retirement, costs are up slightly. This is due to inflation in everything from food to holidays – though reduced utility bills have softened the blow.

The new figures are shown below (after tax amounts):

The role of the State pension

The state pension continues to play a vital role, especially for those in two-person households as it typically covers the essentials needed for a Minimum standard of living. But for those hoping for anything beyond the basics, they’ll need more than just the state pension, which is where a workplace pension can play an important role.

Are you saving enough?

Auto-enrolment is helping more people save, but the current 8% minimum contribution rate might not be enough to guarantee the type of retirement lifestyle you want. Pensions UK recommends aiming to contribute at least 12% to boost your chances of a Moderate or Comfortable retirement. If you’re currently saving the bare minimum, now might be a good time to review your finances and see if you’re able to contribute any more to help improve retirement lifestyle.

To see if you’re on track for the type of retirement lifestyle you want to achieve, why not try the ‘Boost your savings’ tool in your online account?

To learn more about the Retirement Living Standards, visit the Pensions UK website.

Related news & insights

-

Is it time for your digital Midlife MOT?

Entering your midlife doesn’t have to mean crisis! Find out how your digital Midlife MOT can help you put things in perspective and plan for the future. -

Reviewing your investment

The amount of money you and your employer pay into the Scheme is not the only way your savings pot can grow in value. Where your savings are invested, and how these investments perform, will have a big impact on how much you’re building up over time. -

Risk & Reward

Whether you’ve been automatically enrolled into the Scheme, or you joined by choice, it’s important to review your investment options regularly. -

How to set your goals and check you’re on track

Having something to aim for helps you to plan and work out the steps you need to take to achieve your goals. This is true of both health and wealth – even your savings goals for when you want to stop working.