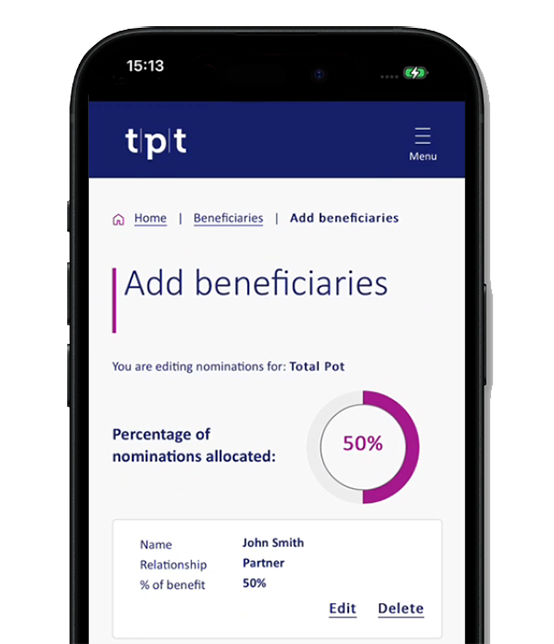

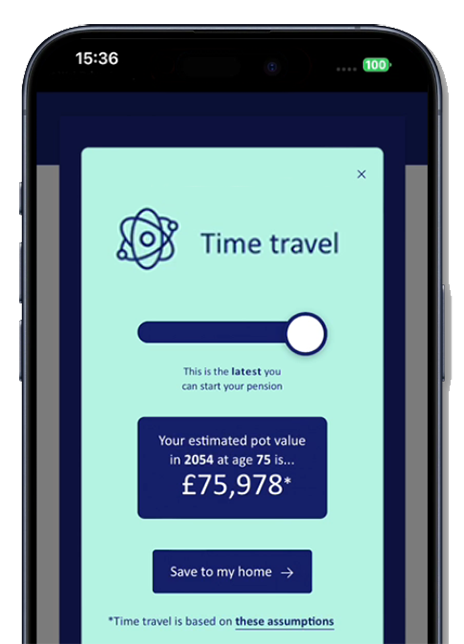

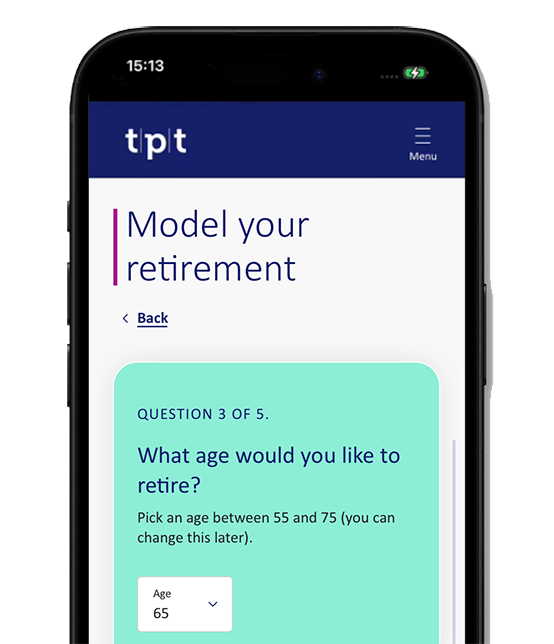

New pension account

Our new pension account is designed to make pensions easy. Members can now save, plan, and manage their retirement from their online pension account. They will also have plenty of support and guidance at their fingertips, with access to helpful planning tools, built-in nudges and a wealth of educational content.

Why choose TPT?

-

Defined Contribution pensions

Our award-winning DC Master Trust pension scheme is designed to support members through their entire savings journey and beyond.

-

High performing default funds

Our default target-date funds (TDFs) have been carefully designed to provide an innovative to and through retirement strategy.

Based on past performance.

-

True at-retirement innovation

We've created a unique solution that offers members a managed monthly income for life (to 95) while remaining in the target date fund strategy, ensuring a smooth transition into retirement.

Related articles

-

TPT hires new Head of Consultant Relations

A central part of Katherine's brief will be to identify and build relationships with employee benefit consultants (EBCs) across the full spectrum of consolidation vehicles TPT offers. -

From pension pot to an income in retirement – driving an industry shift

At the Pensions UK 2025 Conference, TPT's DC Director, Philip Smith, spoke about the kind of guidance members need to help them achieve a simpler, safer, and more secure retirement. -

Reimagining retirement: How workplace pensions can rise to age-old challenges

The infrastructure is there, but the issue of long-term adequacy remains unsolved. TPT's Philip Smith examines whether workplace pensions are fit for purpose. -

TPT appoints Andrew Sheavyn as new Business Development Manager

Andrew will be responsible for delivering TPT’s new business growth, with a focus on its Defined Contribution (DC) and Collective Defined Contribution (CDC) offerings.