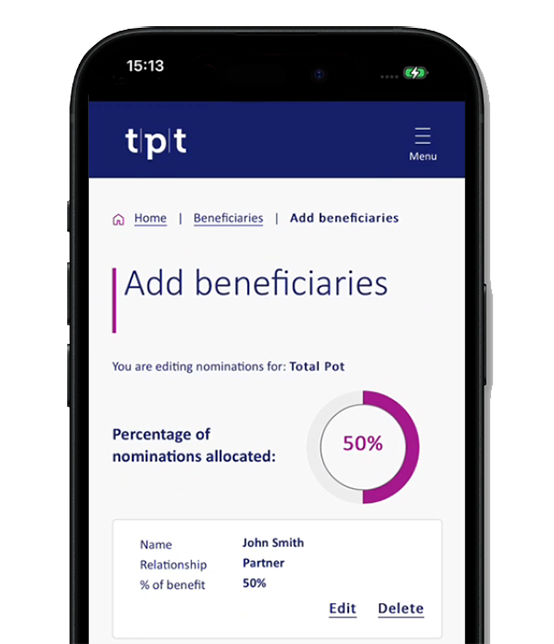

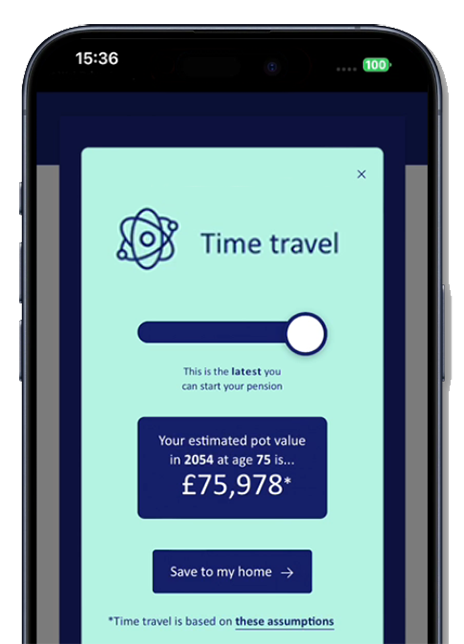

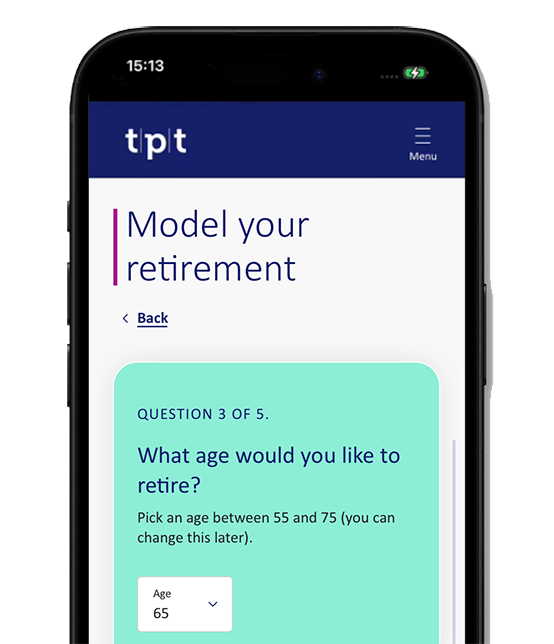

New pension account

Our new pension account is designed to make pensions easy. Members can now save, plan, and manage their retirement from their online pension account. They will also have plenty of support and guidance at their fingertips, with access to helpful planning tools, built-in nudges and a wealth of educational content.

Why choose TPT?

-

Defined Contribution pensions

Our award-winning DC Master Trust pension scheme is designed to support members through their entire savings journey and beyond.

-

High performing default funds

Our default target-date funds (TDFs) have been carefully designed to provide an innovative to and through retirement strategy.

Based on past performance.

-

True at-retirement innovation

We've created a unique solution that offers members a managed monthly income for life (to 95) while remaining in the target date fund strategy, ensuring a smooth transition into retirement.

Related articles

-

TPT completes major digital transformation ahead of new DC retirement offering launch

TPT has introduced a new technology platform to improve the digital experience for DC members and employers and support the launch of its new retirement offering. -

DC pensions: It’s time to shift the focus from price to value

TPT’s DC Director, Philip Smith, evaluates the proposed Value for Money framework and industry shift required to deliver better member outcomes. -

Why the government’s proposal for a £25bn limit for DC mega-funds is unlikely to work

Exploring the government's DC mega fund proposal, TPT’s Philip Smith offers a critical analysis of the potential impact. -

Building a reliable income for life in decumulation for DC members

TPT’s DC Director, Philip Smith, explains the approach to risk mitigation in the design of our new ‘managed income for life’ default DC decumulation proposition.