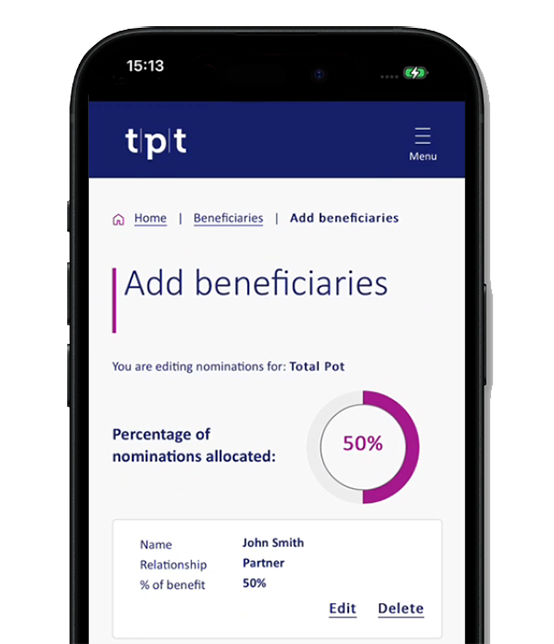

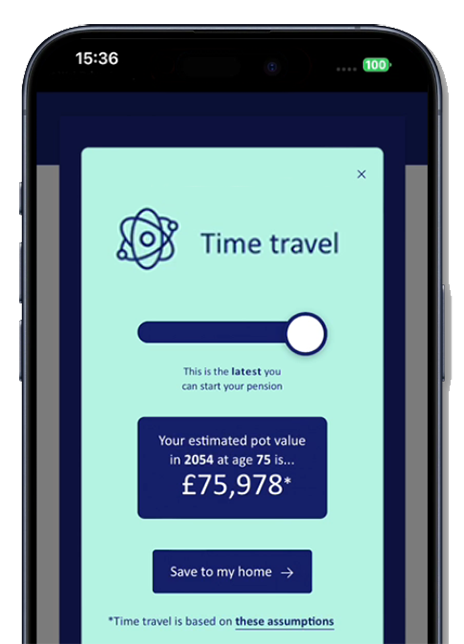

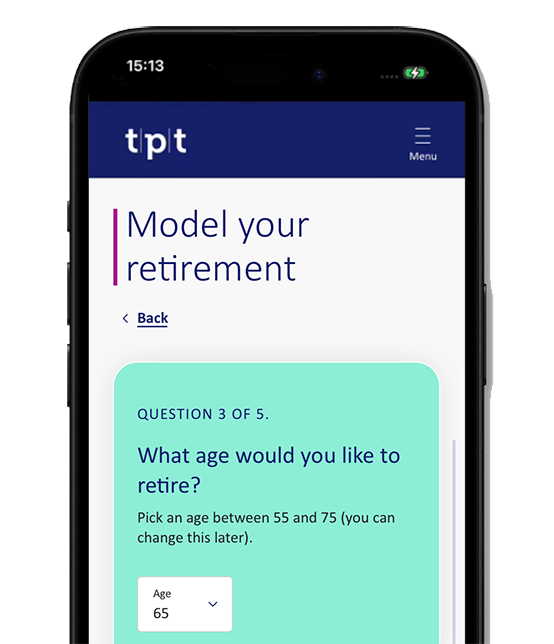

New pension account

Our new pension account is designed to make pensions easy. Members can now save, plan, and manage their retirement from their online pension account. They will also have plenty of support and guidance at their fingertips, with access to helpful planning tools, built-in nudges and a wealth of educational content.

Why choose TPT?

-

Defined Contribution pensions

Our award-winning DC Master Trust pension scheme is designed to support members through their entire savings journey and beyond.

-

High performing default funds

Our default target-date funds (TDFs) have been carefully designed to provide an innovative to and through retirement strategy.

Based on past performance.

-

True at-retirement innovation

We've created a unique solution that offers members a managed monthly income for life (to 95) while remaining in the target date fund strategy, ensuring a smooth transition into retirement.

Related articles

-

TPT appoints Ruari Grant from Pensions UK as new Head of Policy & External Affairs

In his new role, Ruari will be responsible for defining and leading TPT's policy direction and supporting the Executive Board in delivering its policy objectives. -

Getting retirement guidance right – the future of DC depends on it

TPT’s Philip Smith on the infrastructure and behavioural changes needed now to support retirement income adequacy in the future. -

TPT calls for industrywide effort to boost DC investment

TPT’s DC Director, Philip Smith, says fees remain the biggest barrier to master trusts investing in private markets. -

TPT launches first-of-its-kind managed retirement income for life offering

TPT has launched a new Defined Contribution (DC) decumulation solution designed to simplify retirement income planning for savers.