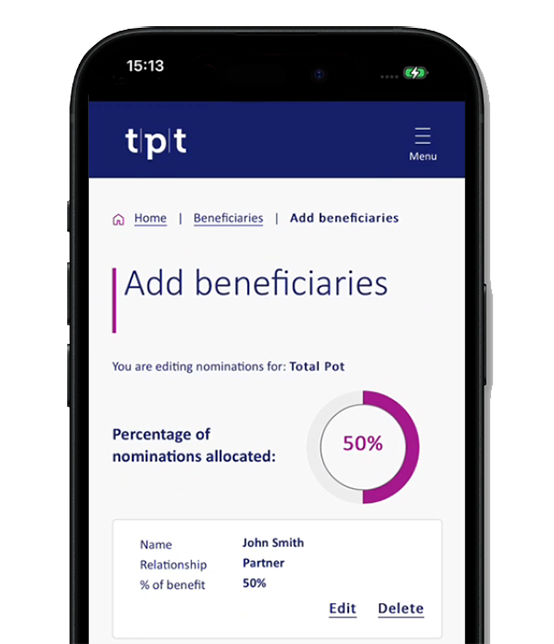

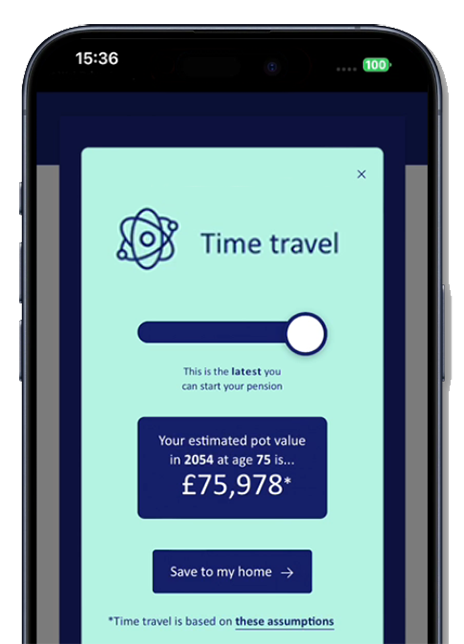

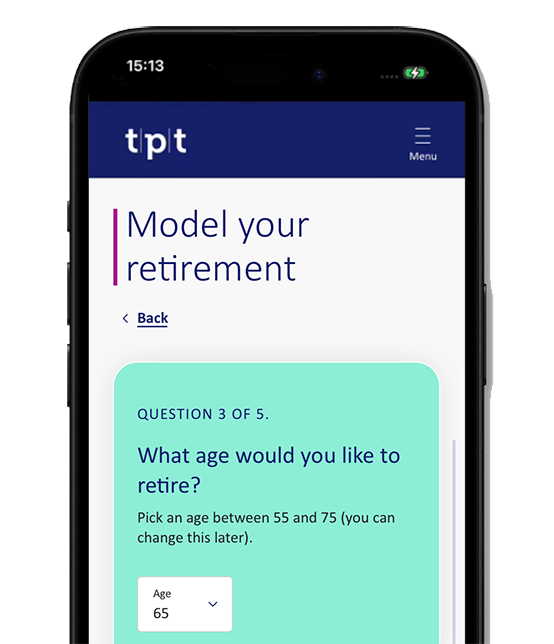

New pension account

Our new pension account is designed to make pensions easy. Members can now save, plan, and manage their retirement from their online pension account. They will also have plenty of support and guidance at their fingertips, with access to helpful planning tools, built-in nudges and a wealth of educational content.

Why choose TPT?

-

Defined Contribution pensions

Our award-winning DC Master Trust pension scheme is designed to support members through their entire savings journey and beyond.

-

High performing default funds

Our default target-date funds (TDFs) have been carefully designed to provide an innovative to and through retirement strategy.

Based on past performance.

-

True at-retirement innovation

We've created a unique solution that offers members a managed monthly income for life (to 95) while remaining in the target date fund strategy, ensuring a smooth transition into retirement.

Related articles

-

Almost half of people approaching retirement uncertain how to access their pension savings

Almost half (49%) of working people approaching retirement, aged between 50 and 59, don’t know how they will access their pension savings, according to new research from TPT. -

Voters want pension reform in Political Party Manifestos

Three in four workers (75%) would be more likely to vote for a political party that reforms defined contribution (DC) pensions, according to new research from TPT Retirement Solutions. -

Corporate Adviser, Master Trust & GPP Defaults report – Key findings

In its 2024 Master Trust and GPP Defaults Report, Corporate Adviser Intelligence looks back on a ”very strong year” for master trusts, during which the global economy stabilised and the value of defined contribution (DC) assets held within multi-employer schemes increased by £113bn. -

The Great At-Retirement Conundrum: Only a third of pension savers are confident enough to make retirement decisions

Only a third of pension savers (35%) feel confident enough to make basic retirement decisions such as choosing how to access their pension when they reach retirement age, according to new research from TPT.